清关和税收

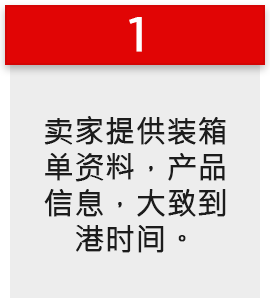

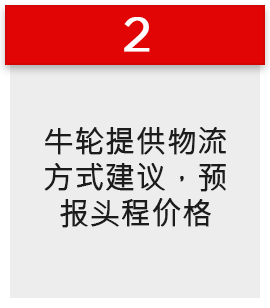

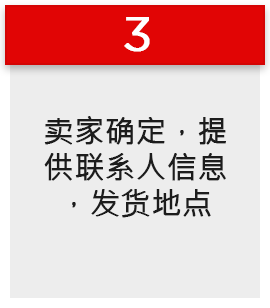

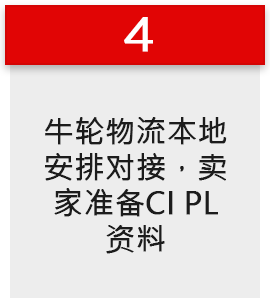

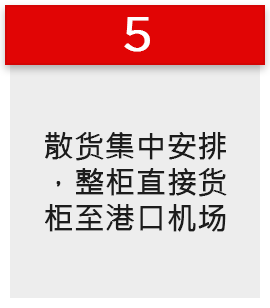

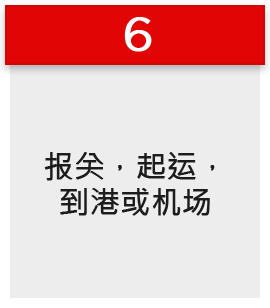

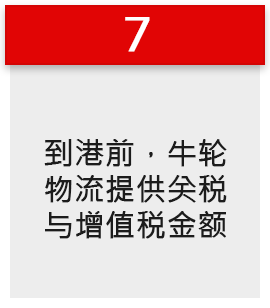

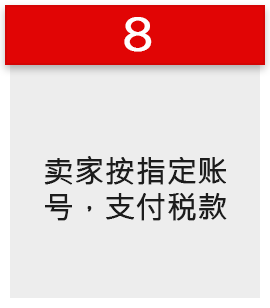

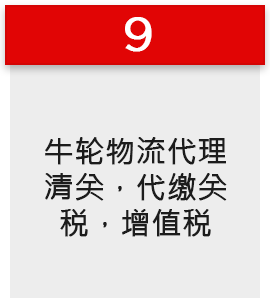

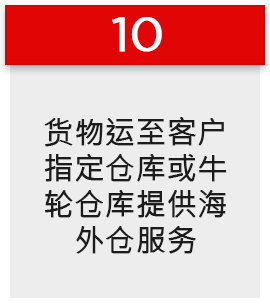

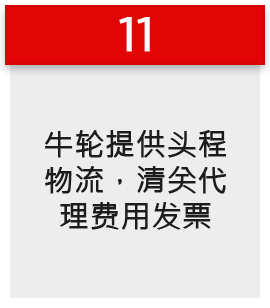

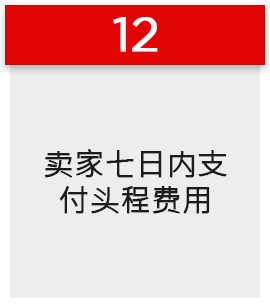

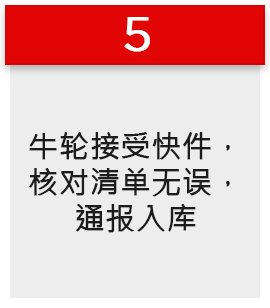

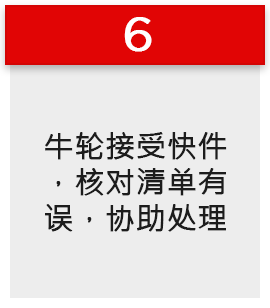

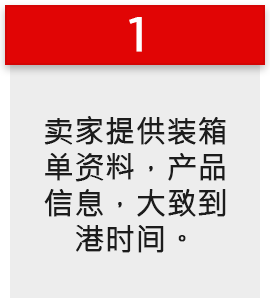

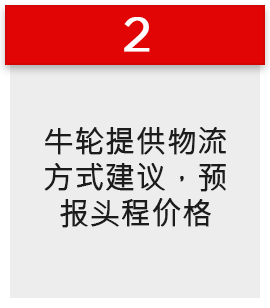

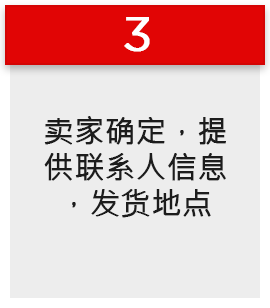

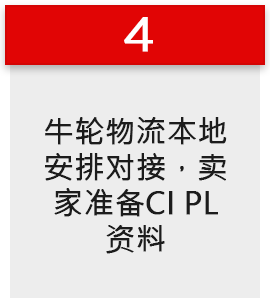

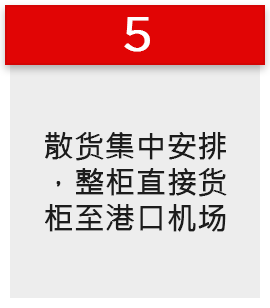

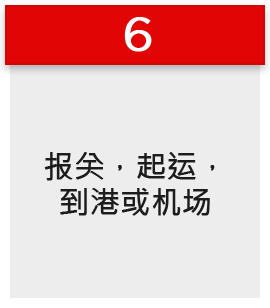

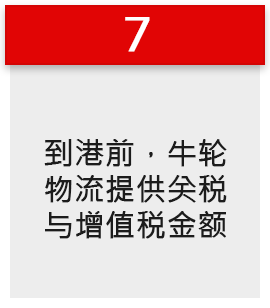

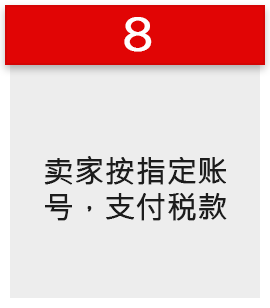

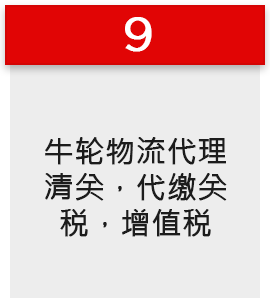

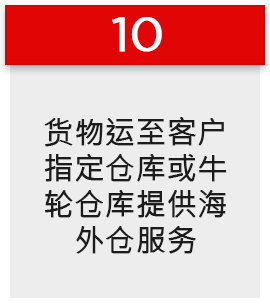

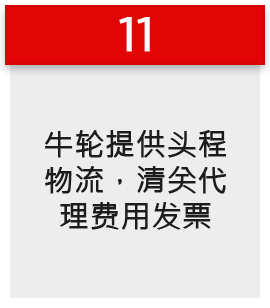

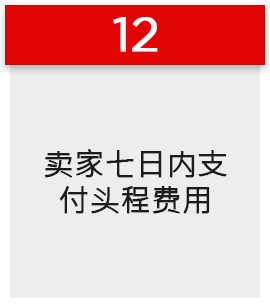

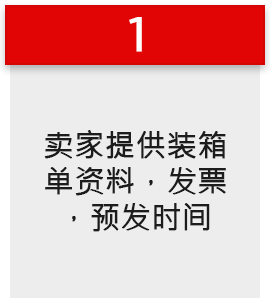

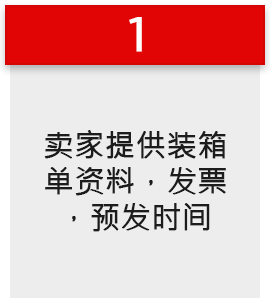

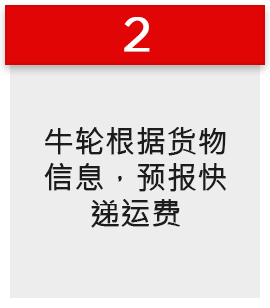

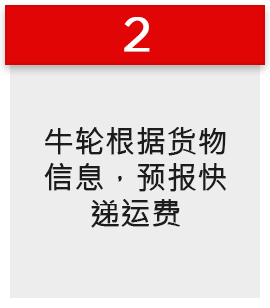

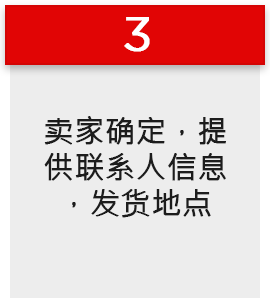

空,铁,海运头程业务流程

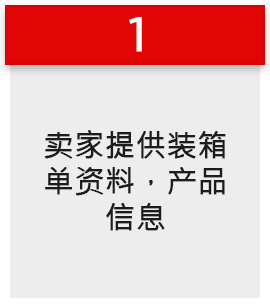

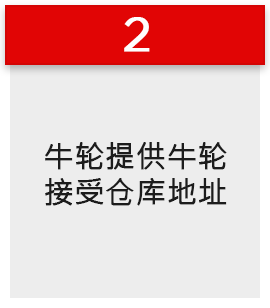

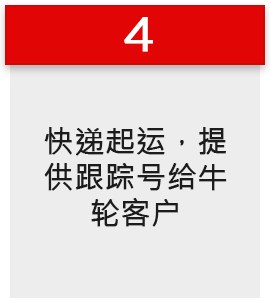

国际快件 UPS DHL TNT 业务流程

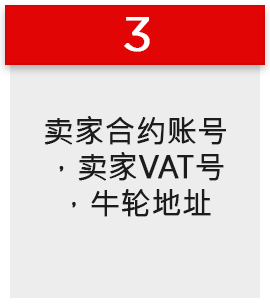

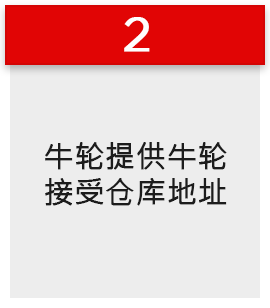

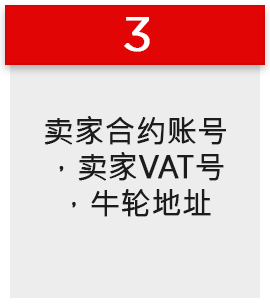

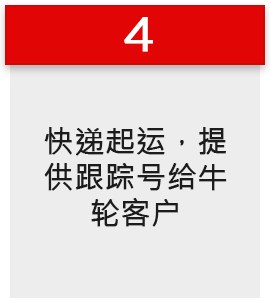

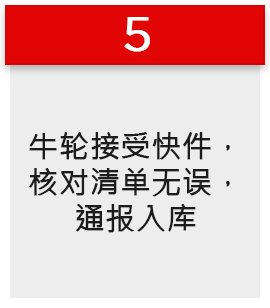

国际快件 UPS DHL TNT卖家合约账号业务流程

清关和税收

清关

清关时,使用客户自有的欧盟VAT账号进行清关。如果客户没有欧盟对应国VAT账号,牛轮意大利也可以提供“欧盟任何国家VAT账号注册”增值服务。关于VAT账号注册请查看“增值服务-意大利VAT注册”服务。

税金计算范例

拥有意大利VAT,并在意大利入关

拥有欧盟其他国家VAT,在意大利入关

清关和税收

清关和税收

清关时,使用客户自有的欧盟VAT账号进行清关。如果客户没有欧盟对应国VAT账号,牛轮意大利也可以提供“欧盟任何国家VAT账号注册”增值服务。关于VAT账号注册请查看“增值服务-意大利VAT注册”服务。

拥有意大利VAT,并在意大利入关

拥有欧盟其他国家VAT,在意大利入关